Inflation has become one of the most talked-about economic terms in recent years. From grocery bills and fuel prices to rent and loan payments, rising costs are affecting everyday life across the world. Headlines frequently warn of a “cost-of-living crisis,” and for many households, inflation is no longer an abstract economic concept, it’s something felt every time money is spent.

But what exactly is inflation? Why has it risen so sharply in recent years? And how does it really affect consumers in their daily lives?

This article explains what is inflation, how it is measured, what causes it, and how it impacts consumers, using real-world examples and straightforward language. We also look at what governments and central banks can (and cannot) do to control inflation—and what consumers can do to manage its effects.

What Is Inflation?

Inflation is the rate at which prices for goods and services increase over time. When inflation rises, the purchasing power of money falls. In simple terms, inflation means your money buys less than it did before.

For example, if inflation is 8% and your income does not rise by the same amount, you are effectively worse off. Even though you still earn the same number of dollars or pounds, those units of money no longer stretch as far.

A classic way to understand inflation is through everyday examples. In 1970, a cup of coffee in the United States cost around 25 cents. By 2019, that same cup cost about $1.59. That does not mean coffee suddenly became more luxurious—it reflects decades of inflation across the economy.

Inflation is not limited to one product or service. It refers to broad price increases across many sectors, such as food, energy, housing, transport, healthcare, and education.

Why Is Inflation in the Headlines?

Inflation continues to dominate headlines in 2025 because, while price pressures have eased from the extreme highs seen after the pandemic, they remain uneven and stubbornly elevated in many parts of the world. According to the International Monetary Fund (IMF), global inflation is expected to average around 3.5% in 2025, higher than the levels that prevailed before COVID-19. Advanced economies, including the United States, the euro area, and the United Kingdom, are seeing inflation cool closer to central bank targets, with rates hovering near 2%–2.2%. However, inflation remains a much bigger challenge for emerging market and developing economies, where the IMF projects an average inflation rate of about 4.4% in 2025. Some regions, such as Sub-Saharan Africa and the Middle East and Central Asia, continue to experience significantly higher inflation, driven by food costs, currency pressures, and geopolitical risks. This uneven global picture—where inflation is under control in some countries but still eroding purchasing power in others—is why inflation remains a key economic and political issue in 2025.

What Does Inflation Mean for Your Money?

The most direct effect of inflation is a loss of purchasing power.

If prices rise faster than wages, consumers can afford fewer goods and services even though they are earning the same income. This is why inflation often feels like a pay cut.

For example:

- A weekly grocery bill that used to cost $100 may now cost $120.

- Fuel, electricity, and gas bills rise, leaving less money for savings or discretionary spending.

- Rent and mortgage payments increase, putting pressure on housing affordability.

Over time, persistent inflation can force households to cut back on non-essential spending, delay major purchases, or rely more heavily on credit.

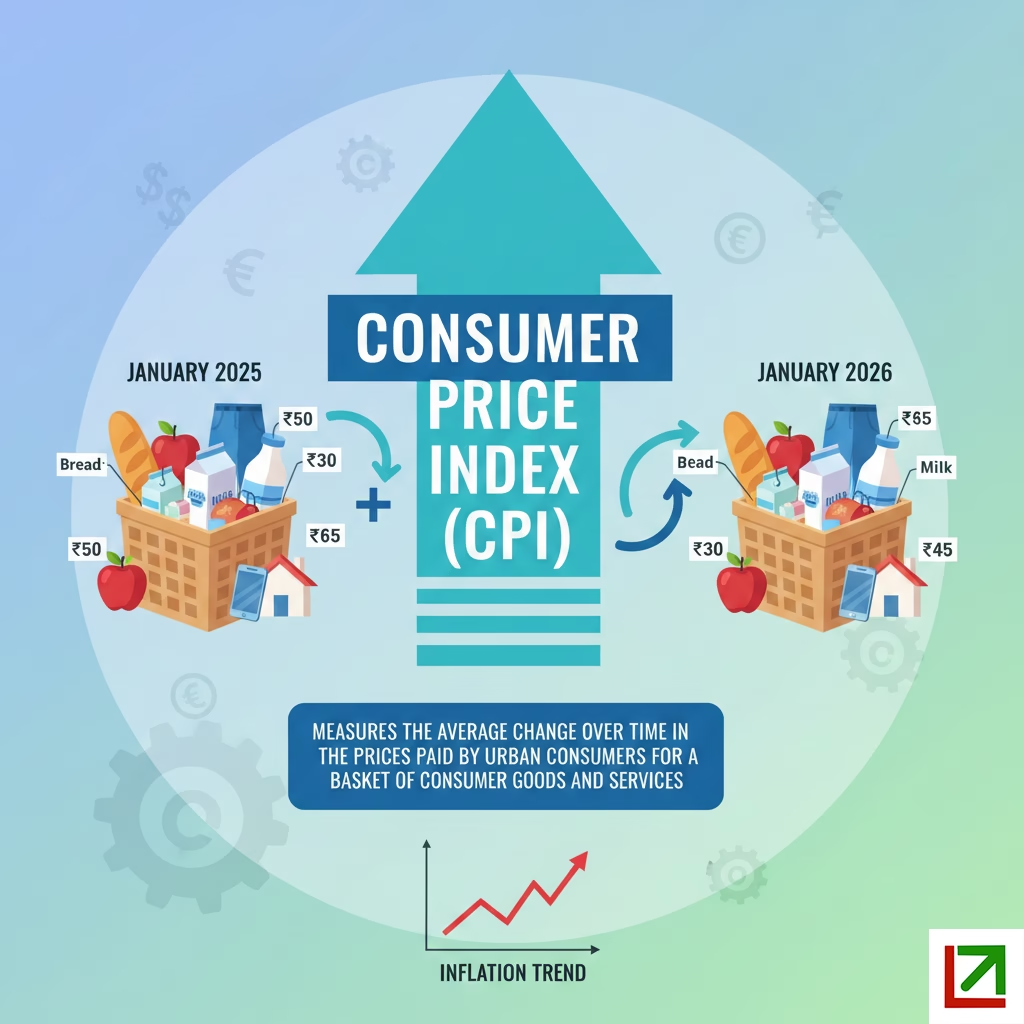

How Is Inflation Measured?

Inflation is measured using a basket of goods and services that represents what households typically buy.

This basket includes everyday items such as:

- Food and beverages

- Fuel and energy

- Clothing

- Transport

- Healthcare

- Housing-related costs

- Entertainment and subscriptions

Statistical agencies track how the prices of these items change month to month and year to year.

Consumer Price Index (CPI)

The most common measure of inflation is the Consumer Price Index (CPI). CPI tracks the average change in prices paid by consumers for a specific basket of goods and services.

- In the United States, the basket includes items like gasoline, food, motor oil, and healthcare services.

- In the United Kingdom, the basket contains more than 700 items, ranging from bread and bus tickets to cars and digital subscriptions.

The percentage change in the CPI over time is reported as the inflation rate.

There is ongoing debate about what should be included in the basket and how inflation should be measured. However, CPI remains the most widely used and understood indicator.

How Does Inflation Affect Consumers?

Inflation affects consumers in several important ways:

1. Higher Cost of Living

The most visible impact is the rising cost of everyday essentials.

For example:

- Pasta prices in the UK rose 60% in the year to September, according to the Office for National Statistics.

- Energy prices surged in many countries, sharply increasing heating and electricity bills.

- Food inflation has hit lower-income households hardest, as essentials make up a larger share of their spending.

These increases force households to make tough choices about spending priorities.

2. Savings Lose Value

Inflation reduces the real value of savings.

If inflation is 6% and your savings account pays 2% interest, your money is effectively losing 4% of its value each year. This discourages saving and can push people toward riskier investments in an attempt to keep up with rising prices.

3. Higher Borrowing Costs

When inflation rises, central banks usually increase interest rates to slow it down. Higher interest rates mean:

- More expensive mortgages

- Higher credit card interest

- Increased costs for personal and auto loans

Consumers with variable-rate loans feel these increases most quickly, while new borrowers face higher monthly payments.

4. Wage Pressure and Income Stress

In theory, wages should rise with inflation. In reality, wage growth often lags behind price increases.

When inflation outpaces wage growth:

- Household budgets tighten

- Consumer confidence falls

- Spending slows, affecting overall economic growth

This mismatch between wages and prices is one of the main reasons inflation causes widespread frustration.

Is Inflation Always Bad?

Inflation is not always harmful. In fact, moderate inflation is considered healthy for an economy.

Most economists agree that around 2% annual inflation:

- Encourages spending and investment

- Supports business growth

- Helps prevent deflation, which can stall economic activity

When inflation is low and stable, consumers and businesses can plan confidently for the future.

Problems arise when inflation becomes too high or unpredictable, especially when it exceeds wage growth.

What Causes Inflation?

Inflation can be caused by several factors, often acting together.

1. Easy Monetary Policy

Over the long term, inflation is closely linked to monetary policy.

When central banks:

- Keep interest rates too low for too long, or

- Increase the money supply rapidly

More money chases the same amount of goods and services, pushing prices higher.

2. Demand-Pull Inflation

Demand-pull inflation occurs when demand exceeds supply.

A good example came after the COVID-19 pandemic:

- Demand for cars rebounded quickly

- Semiconductor shortages limited vehicle production

- Prices for new and used cars surged

Too much demand and too little supply results in higher prices.

3. Cost-Push Inflation

Cost-push inflation happens when input costs rise, forcing businesses to charge more.

Examples include:

- Higher energy prices

- Rising raw material costs

- Increased labor expenses

During the pandemic and its aftermath, disruptions to global supply chains and commodity markets pushed production costs higher across many industries.

4. Global Shocks and Geopolitics

Some inflation drivers are outside the control of any single country.

For example:

- Russia’s invasion of Ukraine disrupted gas supplies to Europe

- UK gas prices rose 96% in the year to September 2022

- Food and energy prices became highly volatile worldwide

These global shocks make inflation harder to manage through domestic policy alone.

How Do Governments and Central Banks Control Inflation?

Interest Rates

The primary tool used to control inflation is interest rates.

When central banks raise rates:

- Borrowing becomes more expensive

- Consumers and businesses spend less

- Demand cools, reducing pressure on prices

Central banks like the Federal Reserve, European Central Bank, and Bank of England typically aim to keep inflation close to 2%.

Fiscal Policy

Governments can also influence inflation through fiscal measures such as:

- Adjusting taxes

- Reducing or increasing public spending

- Implementing policies to improve productivity

However, fiscal tools often work more slowly than interest rate changes.

How Inflation Affects Consumers vs Companies

Impact on Consumers

- Reduced purchasing power

- Higher household expenses

- Increased financial stress

- Lower savings value

Impact on Companies

- Higher input costs

- Pressure on profit margins

- Difficult pricing decisions

- Risk of reduced demand if prices rise too much

Ultimately, companies often pass higher costs on to consumers, reinforcing inflationary pressures.

What Can Consumers Do to Cope with Inflation?

While individuals cannot control inflation, they can manage its effects by:

- Reviewing budgets and tracking spending

- Reducing high-interest debt

- Comparing prices and shopping smarter

- Focusing on long-term financial planning

- Seeking savings options that offer inflation-beating returns

Financial awareness becomes especially important during periods of high inflation.

Conclusion: Why Inflation Matters to Everyone

Inflation affects nearly every aspect of daily life, from the cost of food and energy to housing, savings, and borrowing. While moderate inflation is a normal part of a healthy economy, rapid and persistent price increases can strain households and create economic uncertainty.

Although central banks and governments work to bring inflation under control, some factors—such as global energy prices and geopolitical events, remain beyond their reach.

What is clear is that inflation has become one of the defining economic challenges of recent years. Understanding how it works and how it affects consumers is the first step toward navigating its impact and making informed financial decisions in an uncertain world.

Other topics you might be interested in:

What Is the Federal Reserve? Meaning, Role and Why It Matters