The Consumer Price Index (CPI) is one of the most important economic indicators in the world. It tells us how much the prices of everyday goods and services are changing over time. In simple terms, CPI helps measure inflation and shows whether the cost of living is rising, falling, or staying stable.

Every month, investors, traders, policymakers, and ordinary households closely watch the CPI report. A single CPI release can move stock markets, bond yields, currencies, and even influence central bank decisions within minutes.

In this article, we’ll explain what is CPI, how it is calculated, why it matters, how markets react to CPI data, and how investors and traders use it, all in plain and easy-to-understand language.

What Is Consumer Price Index (CPI)?

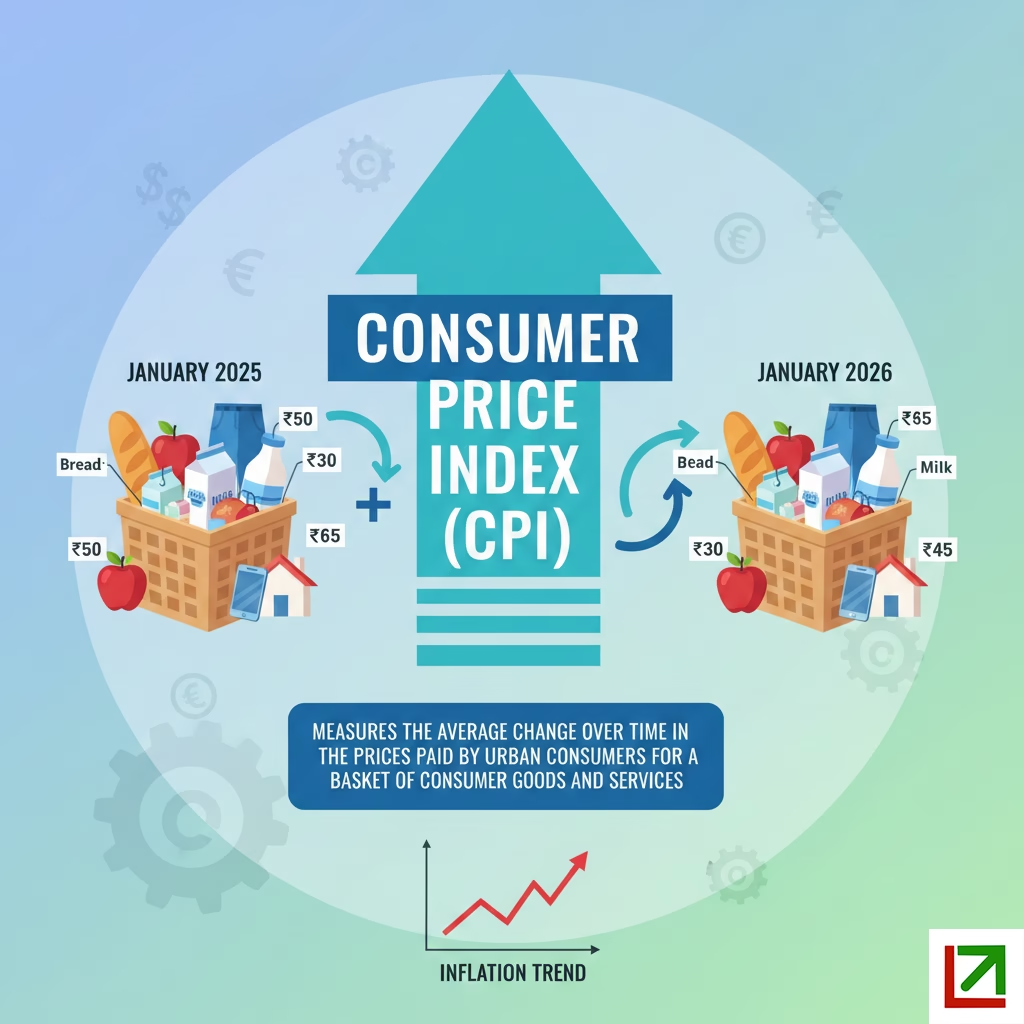

The Consumer Price Index (CPI) measures the average change in prices paid by consumers for a basket of goods and services over time. It is the most widely used indicator of inflation.

In the United States, CPI is calculated and published by the Bureau of Labor Statistics (BLS), a government agency under the Department of Labor. The report is released monthly, usually during the second week of the following month.

If CPI rises, it means prices are increasing and inflation is occurring.

If CPI falls, it suggests prices are declining, which may indicate deflation.

What Does the CPI Basket Include?

CPI tracks the prices of goods and services that people regularly buy in their daily lives. The basket is designed to reflect real consumer spending habits.

The main categories include:

- Food and beverages

- Housing and rent

- Transportation

- Healthcare

- Energy (fuel, electricity, gas)

- Education and communication

- Recreation

- Apparel

Each category is given a weight, based on how much consumers spend on it. For example, housing has the largest weight because it takes up a major share of household expenses.

How CPI Data Is Collected

The BLS collects around 80,000 prices every month from:

- Retail stores

- Online sellers

- Service providers

- Rental housing units

- Medical offices

These prices are collected across 75 urban areas and represent about 93% of the U.S. population.

What Is Included and Excluded?

Included in CPI:

- Sales taxes

- Excise taxes

- User fees

Not included in CPI:

- Income taxes

- Investment prices (stocks, bonds, crypto)

- Life insurance premiums

CPI focuses only on out-of-pocket consumer spending.

How CPI Is Adjusted

Substitution Effect

When prices rise, consumers often switch to cheaper alternatives. For example, if beef becomes expensive, people may buy more chicken instead. CPI accounts for this behavior through periodic updates to its basket.

Quality Adjustments

If a product improves in quality or features (for example, smartphones), CPI adjusts prices to reflect the added value rather than treating it as pure inflation.

Weight Updates

The weights of CPI categories are updated regularly using consumer spending surveys. This ensures the index stays relevant as spending patterns change.

Housing and Owners’ Equivalent Rent

Housing is the largest component of CPI, accounting for over 40% of the index.

For homeowners, CPI uses something called Owners’ Equivalent Rent (OER). Instead of tracking home prices, it estimates how much homeowners would pay if they rented their own homes. This method helps reflect housing costs more accurately in daily living expenses.

Types of Consumer Price Index (CPI)

The BLS publishes two main CPI indexes every month.

CPI-U (All Urban Consumers)

- Covers about 93% of the U.S. population

- Excludes rural residents, farm households, and military bases

- This is the headline CPI reported in the media

- Most relevant for financial markets

CPI-W (Urban Wage Earners and Clerical Workers)

- Covers about 29% of the population

- Focuses on wage earners and clerical workers

- Used to adjust Social Security payments, pensions, and federal benefits

- Also used to adjust income tax brackets to prevent inflation-related tax increases

Headline CPI vs Core CPI

Headline CPI

- Includes all items

- Highly influenced by food and energy prices

- Can be volatile month to month

Core CPI

- Excludes food and energy

- Considered a better measure of underlying inflation

- Closely watched by central banks

Both are important, but core CPI often drives policy expectations.

Month-over-Month vs Year-over-Year CPI

CPI is reported in two key ways:

Month-over-Month (MoM)

- Shows short-term inflation momentum

- Markets often react strongly to surprises here

Year-over-Year (YoY)

- Shows long-term inflation trends

- Useful for understanding broader direction

A small monthly surprise can cause large market moves, even if yearly inflation looks stable.

Why CPI Is So Important

1. Measures Cost of Living

CPI shows how much everyday life is getting more expensive for consumers.

2. Influences Central Bank Policy

Central banks use CPI to decide whether to:

- Raise interest rates

- Cut interest rates

- Keep policy unchanged

3. Affects Wages and Benefits

CPI is used for:

- Social Security cost-of-living adjustments (COLA)

- Government wages and pensions

- Private sector wage negotiations

4. Impacts Financial Markets

Stocks, bonds, and currencies often move sharply after CPI releases.

Why Markets React Strongly to CPI Data

Inflation Expectations and Interest Rates

Higher CPI increases the chance of tighter monetary policy. Lower CPI reduces pressure on central banks.

Interest rates affect:

- Stock valuations

- Bond prices

- Currency strength

That’s why CPI has an outsized impact on markets.

CPI Surprises vs Expectations

Markets price in expectations before the release.

What matters most is the difference between actual CPI and forecasts.

Even a small miss or beat can trigger large moves if traders are positioned heavily.

How Different Assets React to CPI

Stocks

- Growth stocks are sensitive to inflation

- High CPI can pressure valuations

Bonds

- Bond yields usually rise with higher inflation

- Prices fall when yields rise

Currencies

- Higher CPI can strengthen a currency if rate hikes are expected

- Lower CPI can weaken it

How Traders Use CPI Data

Short-Term Trading

Traders focus on:

- Release timing

- Forecasts vs actual numbers

- Volatility spikes

CPI days often bring sharp, fast moves, especially in forex and index futures.

Risk Management

Many traders:

- Reduce position sizes

- Avoid new trades before the release

- Focus on post-data trends

How Long-Term Investors Use CPI

Long-term investors care less about one report and more about trends.

They analyze:

- Whether inflation is rising or falling

- Central bank responses

- Impact on earnings and valuations

Consistency matters more than one CPI print.

Limitations of CPI

While CPI is essential, it is not perfect.

Lagging Components

Housing inflation reacts slowly to real-world changes.

Average Basket Problem

Different households experience inflation differently.

Market Overreaction

Short-term moves can exaggerate the importance of one data point.

Context always matters.

CPI and Inflation Types

Inflation can rise due to:

- Demand-pull inflation: Demand exceeds supply

- Cost-push inflation: Rising production costs

- Inflation expectations: Prices rise because people expect inflation

CPI captures the result, not the cause.

CPI and Inflation-Protected Investments

Treasury Inflation-Protected Securities (TIPS)

TIPS adjust payments based on CPI, protecting investors from inflation.

Inflation Swaps

Advanced investors use derivatives tied to CPI to hedge or profit from inflation trends.

Practical Uses of CPI

CPI is used to:

- Adjust Social Security payments

- Index tax brackets

- Modify government assistance programs

- Adjust economic data for inflation

Millions of people are directly affected by CPI every year.

Bottom Line: What CPI Means for Investors and Consumers

The Consumer Price Index (CPI) is the most widely followed measure of inflation and cost of living. It tracks changes in the prices of everyday goods and services and plays a central role in economic decision-making.

For investors, CPI shapes interest rate expectations and market trends.

For consumers, it affects wages, benefits, and purchasing power.

For policymakers, it guides monetary policy decisions.

Understanding CPI helps you better navigate markets, inflation risks, and long-term financial planning.

Other topics you might be interested in:

What Is the Federal Reserve? Meaning, Role and Why It Matters

What Is Inflation? Meaning, Causes and How It Affects Consumers

What Are Interest Rates and Why They Matter to the Economy?

Economic Data Explained: How Macro Numbers Shape Financial Markets