When choosing any type of insurance– health, auto, home, or even business insurance- you’ll always run into two important terms: insurance premium and insurance deductible. They may sound similar, but they work very differently and have a big impact on how much you pay, both regularly and during emergencies.

Understanding insurance deductible vs premium is essential if you want to avoid surprises, manage your budget, and pick the right insurance plan for your needs. Many people focus only on the monthly cost and overlook what happens when they actually file a claim. That’s where confusion, and unexpected expenses, often begin.

In this guide, we’ll clearly explain what premiums and deductibles are, how they work together, and how to decide which option makes the most financial sense for you.

What Is an Insurance Premium?

An insurance premium is the amount you pay to keep your insurance policy active. Think of it as a subscription fee for financial protection.

You pay your premium whether or not you ever use the insurance.

How premiums are paid

Premiums are usually paid:

- Monthly

- Quarterly

- Semi-annually

- Annually

For example, if your health insurance premium is $300 per month, you’ll pay $3,600 per year just to keep the policy in force.

Why premiums can increase

Insurance premiums can go up for several reasons:

- You filed one or more claims

- The cost of services increased (medical care, car repairs, construction)

- Your risk profile changed (age, location, driving record)

- Inflation and market conditions

If you stop paying your premium, your insurance coverage will be canceled, even if you’ve never made a claim.

What Is an Insurance Deductible?

An insurance deductible is the amount of money you must pay out of your own pocket before your insurance company starts paying its share.

Deductibles usually reset every year.

Simple example

If your auto insurance deductible is $500 and you have an accident that causes $2,000 in damage:

- You pay the first $500

- Your insurance pays the remaining $1,500

If the damage is less than your deductible, you pay the full amount yourself.

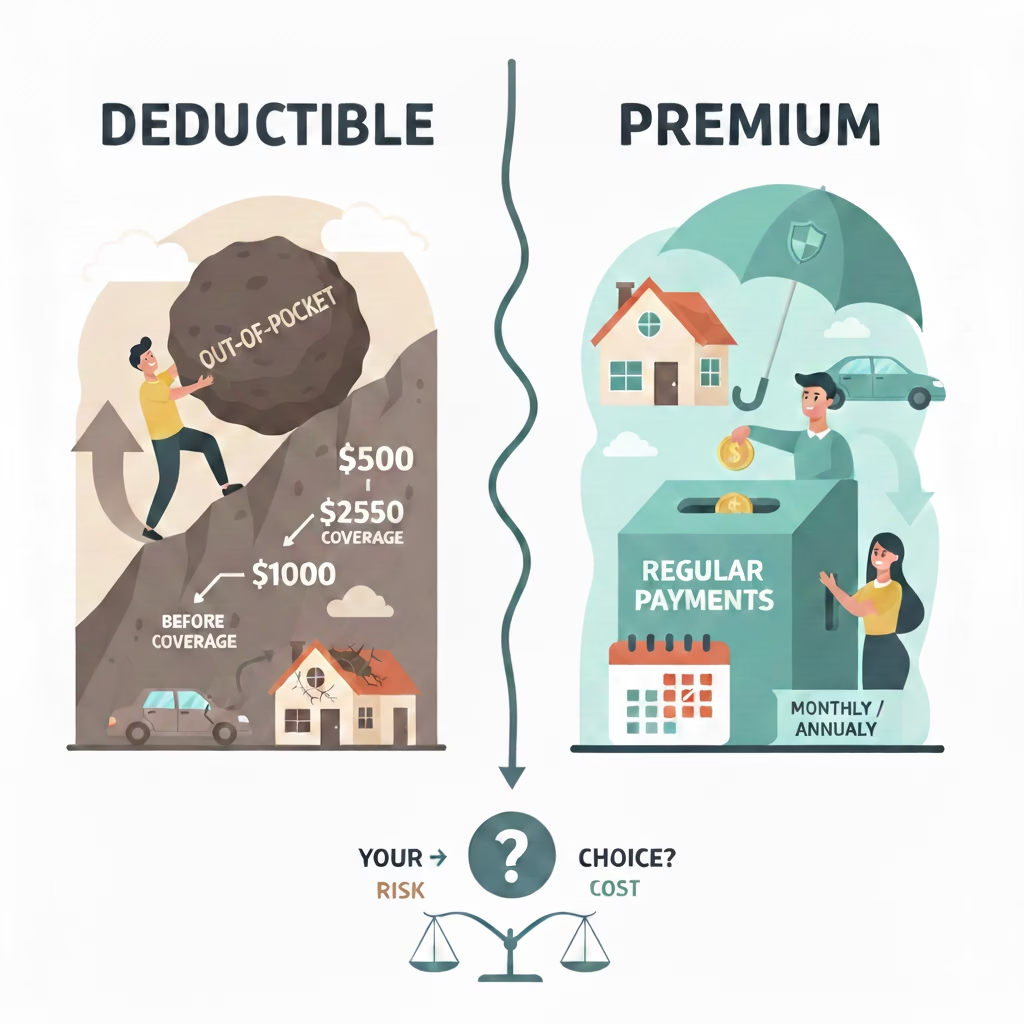

Insurance Deductible vs Premium: The Key Difference

The easiest way to understand insurance deductible vs premium is this:

- Premium = what you pay to have insurance

- Deductible = what you pay when you use insurance

You pay premiums regularly.

You pay deductibles only when you file a claim.

They serve different purposes but are closely connected.

How Premiums and Deductibles Are Related

Premiums and deductibles have an inverse relationship.

- Lower premium → higher deductible

- Higher premium → lower deductible

Insurance companies balance these two costs so that coverage remains affordable for both you and the insurer.

Why this relationship exists

If a policy had both:

- A low premium and

- A low deductible

It would be expensive for the insurance company.

If a policy had:

- A high premium and

- A high deductible

It would be unattractive to customers.

So insurers adjust one when the other changes.

Insurance Deductible vs Premium in Health Insurance

Health insurance is where the premium vs deductible comparison matters most, because healthcare costs can add up quickly.

What is a health insurance premium?

A health insurance premium is the monthly amount you pay for coverage, whether or not you visit a doctor.

Many people pay premiums through payroll deductions, and employers often cover part of the cost.

What is a health insurance deductible?

A health insurance deductible is what you must pay for covered services before your insurance starts paying.

For example:

- Annual deductible: $2,000

- You pay the first $2,000 of covered care

- After that, insurance pays most costs

How a Health Insurance Deductible Works

Let’s say:

- Deductible: $1,000

- Emergency room visit: $800

You pay the full $800 because you haven’t met your deductible.

Now imagine:

- Surgery costs $50,000

You pay:

- First $1,000 (your deductible)

- Insurance covers the rest (subject to coinsurance rules)

Does Your Premium Count Toward Your Deductible?

No.

Your premium does not count toward your deductible.

Premiums also do not count toward your out-of-pocket maximum.

They are separate costs:

- Premium = cost to keep coverage

- Deductible = cost when you receive care

Deductible vs Copay vs Coinsurance

Many people confuse deductibles with other out-of-pocket costs.

Deductible

- What you pay before insurance starts covering most services

Copay

- A fixed fee you pay for a service (example: $25 doctor visit)

Coinsurance

- A percentage you pay after meeting your deductible (example: 20%)

All three affect how much healthcare actually costs you.

Deductible vs Out-of-Pocket Maximum

This is another important distinction.

- Deductible: What you pay before insurance helps

- Out-of-pocket maximum: The most you’ll pay in a year

Once you reach your out-of-pocket maximum, insurance pays 100% of covered care for the rest of the year.

Premiums are not included in this limit.

High-Deductible vs Low-Deductible Insurance Plans

High-deductible plans

- Lower monthly premiums

- Higher out-of-pocket costs when care is needed

- Often paired with Health Savings Accounts (HSAs)

Best for:

- Healthy individuals

- Those who rarely use medical services

- People with emergency savings

Low-deductible plans

- Higher monthly premiums

- Lower costs when receiving care

Best for:

- Chronic conditions

- Frequent doctor visits

- Families with ongoing medical needs

Insurance Deductible vs Premium in Auto Insurance

Auto insurance follows the same basic rules.

- Premium: Paid monthly or annually

- Deductible: Paid when you file a claim

Typical auto deductibles range from $250 to $1,000.

Choosing a higher deductible lowers your premium but increases what you pay after an accident.

Insurance Deductible vs Premium in Homeowners Insurance

Home insurance deductibles can be:

- Flat dollar amounts ($500–$5,000)

- Percentage-based (1%–2% of home value)

A higher deductible can significantly lower your premium but may be costly after a major loss.

Insurance Deductible vs Premium for Businesses

Business insurance also uses deductibles and premiums to share risk.

- High-risk industries pay higher premiums

- Businesses can choose higher deductibles to lower costs

- Professional and property policies often offer deductible options

Choosing the right balance protects cash flow while managing risk.

Why Higher Deductibles Lower Insurance Premiums

When you agree to pay more out of pocket during a claim, the insurer takes on less risk. In return, they charge you less each month.

This trade-off helps:

- Reduce premiums

- Encourage responsible use of insurance

- Keep coverage affordable

Which Is Better: Higher Premium or Higher Deductible?

There’s no universal answer. The right choice depends on:

Your health or risk level

- Frequent care → lower deductible

- Rare claims → higher deductible

Your financial cushion

- Emergency savings → higher deductible possible

- Tight budget → lower deductible safer

Your peace of mind

- Some people prefer predictable monthly costs

- Others prefer lower premiums and accept risk

Can You Change Your Premium or Deductible Mid-Year?

In most cases, no.

Premiums and deductibles are fixed for the policy year.

However, you may change plans during:

- Open Enrollment

- Special Enrollment after a qualifying life event (marriage, job loss, birth)

How Health Savings Accounts (HSAs) Fit In

HSAs are savings accounts, not insurance plans.

They:

- Pair with high-deductible health plans

- Allow tax-free savings for medical expenses

- Can be used to pay deductibles

HSAs can make high-deductible plans more manageable.

Common Mistakes People Make When Comparing Premium vs Deductible

- Choosing the lowest premium without checking the deductible

- Ignoring out-of-pocket maximums

- Forgetting preventive care is often covered

- Not planning for emergencies

Understanding insurance deductible vs premium helps you avoid these costly mistakes.

Final Thoughts: Insurance Deductible vs Premium Explained Simply

Insurance premiums and deductibles work together to balance cost and risk.

- Premiums keep your policy active

- Deductibles apply when you need coverage

- Lower premiums usually mean higher deductibles

- Higher premiums usually mean lower deductibles

The best insurance plan is not the cheapest one- it’s the one that fits your health, lifestyle, and budget.

When you understand how insurance deductible vs premium really works, you’re in control of your insurance decisions instead of being surprised by them.

People also ask:

Q1. What is the main difference between an insurance premium and a deductible?

An insurance premium is what you pay regularly to keep coverage active, while a deductible is what you pay out of pocket before insurance starts paying.

Q2. Does my insurance premium count toward my deductible?

No, premiums do not count toward your deductible or your out-of-pocket maximum.

Q3. Is a higher deductible better than a higher premium?

It depends on your health, risk level, and savings. Higher deductibles mean lower premiums, but higher costs when filing a claim.

Q4. Why do high-deductible plans have lower premiums?

Because you agree to pay more upfront when you need care, the insurer charges less each month.

Q5. What is better for frequent medical visits: low deductible or low premium?

A low-deductible, higher-premium plan is usually better if you need frequent medical care.

Other topics you might be interested in:

What Is Insurance? Meaning, Types, Benefits, and How It Works in the United States

10 Insurance Myths That Are Costing You More Money Than You Think