Interest rates affect almost every part of our financial lives, from home loans and credit cards to savings accounts and investments. Even small changes in interest rates can have a powerful impact on households, businesses, and the overall economy. That is why interest rates are closely watched by governments, central banks, investors, and everyday consumers.

In simple terms, interest rates determine how much it costs to borrow money and how much you earn when you save money. But their influence goes far beyond individual loans or savings accounts. Interest rates shape spending habits, business growth, inflation, employment, stock markets, and long-term economic stability.

This article explains what interest rates are, how they work, who sets them, and why they matter so much, using clear language and real-world examples.

What Are Interest Rates?

An interest rate is the percentage charged on borrowed money or earned on saved money.

- If you borrow money, the interest rate is the cost you pay for using that money.

- If you save money, the interest rate is the reward you earn for depositing your money with a bank or financial institution.

The higher the interest rate:

- Borrowers pay more

- Savers earn more

The lower the interest rate:

- Borrowers pay less

- Savers earn less

Interest rates are usually quoted on an annual basis.

Interest Rates for Borrowers

When you take a loan such as a mortgage, auto loan, student loan, or credit card, the interest rate determines how much extra money you must repay on top of the original amount borrowed (called the principle).

Example:

If you borrow $10,000 at an interest rate of 5% per year:

- You will owe $500 in interest for one year

- Total repayment after one year = $10,500

Borrowing becomes more expensive as interest rates rise. This often leads people to delay major purchases like homes or cars.

Interest Rates for Savers

When you deposit money into a savings account, certificate of deposit (CD), or similar product, the bank pays you interest.

Example:

If you deposit $10,000 in a savings account paying 5% interest:

- You earn $500 in interest after one year

- Your balance becomes $10,500

Higher savings rates benefit people who save money, while lower rates reduce returns on deposits.

Why Even Small Changes in Interest Rates Matter

A change of just 0.25% or 0.50% may seem minor, but it can significantly affect:

- Monthly mortgage payments

- Credit card interest charges

- Business borrowing costs

- Investment returns

- Inflation and economic growth

Because interest rates apply to trillions of dollars across the economy, small adjustments can have large ripple effects.

Why Do Interest Rates Matter to the Economy?

Interest rates influence how much people spend, save, and invest.

When Interest Rates Are Low:

- Borrowing is cheaper

- Consumers are more likely to buy homes, cars, and appliances

- Businesses are more willing to invest and hire

- Economic growth usually increases

When Interest Rates Are High:

- Borrowing becomes expensive

- Consumer spending slows

- Businesses delay expansion

- Inflation may cool

- Economic growth slows

Central banks use interest rates as a tool to balance economic growth and inflation.

Who Sets Interest Rates?

In the United States, the Federal Reserve (the Fed) plays a central role in influencing interest rates.

The Fed does not directly set mortgage or credit card rates. Instead, it sets:

- The federal funds rate (the rate banks charge each other for short-term loans)

- The discount rate (the rate banks pay when borrowing from the Fed)

Banks then use these benchmark rates to set their own lending and savings rates.

The Federal Reserve’s Mandate

The Fed operates under a mandate from Congress to:

- Promote maximum employment

- Maintain stable prices (control inflation)

- Support moderate long-term interest rates

By raising or lowering interest rates, the Fed attempts to keep the economy balanced.

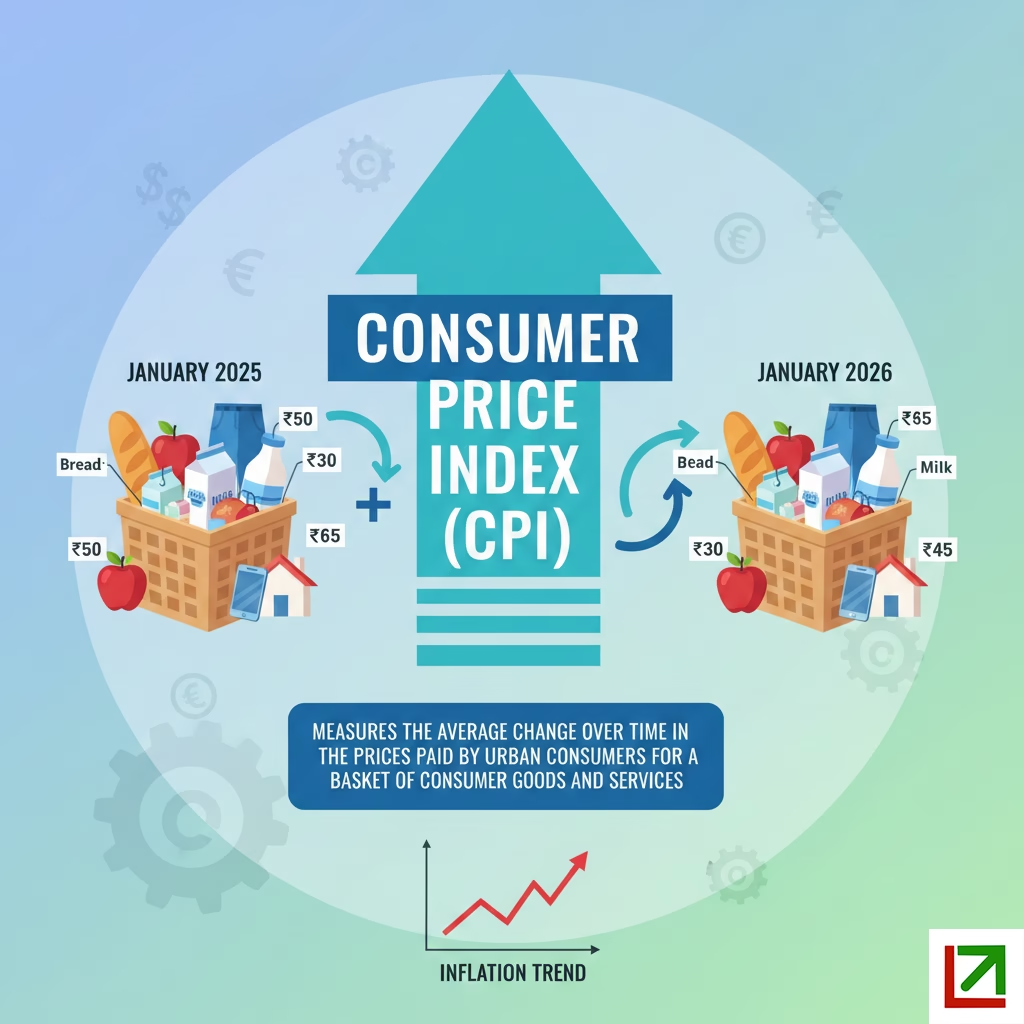

How Interest Rates Help Control Inflation

Inflation occurs when prices rise too quickly, reducing purchasing power.

When Inflation Is High:

- The Fed raises interest rates

- Borrowing becomes more expensive

- Spending slows

- Demand decreases

- Price pressures ease

When Inflation Is Low or Growth Slows:

- The Fed lowers interest rates

- Borrowing becomes cheaper

- Spending increases

- Businesses invest more

- Employment improves

This is why interest rates are one of the Fed’s most powerful tools.

Simple Interest vs. Compound Interest

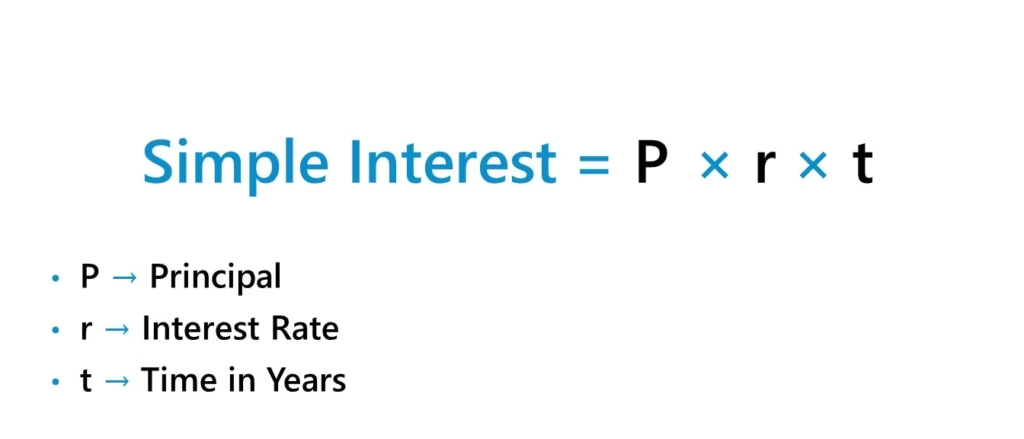

Simple Interest

Simple interest is calculated only on the original loan amount.

Formula:

Example:

A $300,000 loan at 4% simple interest for one year:

- Interest = $12,000

- Total = $312,000

Over 30 years:

- Interest paid = $360,000

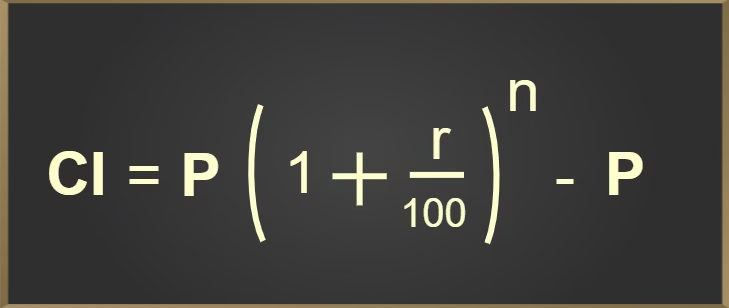

Compound Interest

Compound interest is calculated on:

- The principal

- Plus previously earned interest

This results in higher total interest over time.

Formula:

Example:

A $300,000 loan at 4% compounded over 30 years:

- Total interest ≈ $673,019

This shows why compound interest benefits savers but increases borrowing costs.

Interest Rates and Savings Accounts

Savings accounts and CDs usually earn compound interest, which works in favor of savers.

Banks use deposited funds to issue loans and pay depositors a portion of the interest earned.

Example:

- Bank charges borrowers 8%

- Bank pays savers 5%

- Bank earns the difference

This system connects savers and borrowers through interest rates.

APR vs. APY: What’s the Difference?

APR (Annual Percentage Rate)

- Applies to loans

- Does not include compounding

- Used for mortgages, credit cards, and personal loans

APY (Annual Percentage Yield)

- Applies to savings

- Includes compounding

- Shows the true return on deposits

Understanding this difference helps compare financial products accurately.

Fixed vs. Variable Interest Rates

Fixed Interest Rates

- Stay the same throughout the loan

- Predictable monthly payments

- Common for mortgages and auto loans

Variable Interest Rates

- Change with market conditions

- Payments can increase or decrease

- Common for credit cards and HELOCs

Variable rates can be beneficial when rates fall but risky when rates rise.

Common Types of Loans and Their Interest Rates

- Mortgages: Mostly fixed; some adjustable-rate mortgages (ARMs)

- Auto Loans: Usually fixed

- Credit Cards: Typically variable

- Student Loans: Mostly fixed, private loans may be variable

Each loan type responds differently to changes in interest rates.

How Banks Decide Your Interest Rate

Banks consider several factors:

- The Fed’s benchmark rates

- Inflation and economic conditions

- Supply and demand for credit

- Your credit score and financial history

Borrowers with strong credit profiles usually receive lower interest rates.

Interest Rates and Bonds

Interest rates and bond prices move in opposite directions.

- When rates rise → bond prices fall

- When rates fall → bond prices rise

Long-term bonds are more sensitive to interest rate changes than short-term bonds.

Interest Rates and Stocks

Interest rates do not directly control stock prices, but they influence them.

Higher rates can:

- Increase borrowing costs for companies

- Reduce profits

- Slow expansion and hiring

- Put pressure on stock prices

Lower rates can:

- Encourage investment

- Support higher stock valuations

A balanced portfolio helps manage these risks.

Interest Rates and Savings, Real Estate, and Commodities

- Savings & CDs: Benefit from higher rates

- Real Estate: Higher rates increase mortgage costs and may lower prices

- Commodities: Often face pressure when rates rise

Interest rates shape investment decisions across asset classes.

Interest Rates and Inequality

Data shows differences in mortgage approval and interest rates across racial groups. While some studies point to discrimination, others suggest cost-tradeoffs and borrower choices play a role. Increased automation and stronger enforcement of fair-lending laws aim to reduce disparities over time.

Final Thoughts: Why Interest Rates Matter to You

Interest rates affect:

- Your monthly loan payments

- Your savings growth

- Your investment returns

- Job opportunities

- Inflation and cost of living

Understanding how interest rates work helps you:

- Make smarter borrowing decisions

- Choose better savings products

- Adjust investment strategies

- Plan for economic changes

Whether rates are rising, falling, or staying the same, keeping an eye on interest rates is essential for making informed financial decisions.

Other topics you might be interested in:

What Is the Federal Reserve? Meaning, Role and Why It Matters

What Is Inflation? Meaning, Causes and How It Affects Consumers