What Is Bond Yield? Definition, Calculation, Types & Examples

Bonds are often seen as the calmer cousin of stocks. They don’t make headlines every day, and they rarely deliver sudden surprises. Yet, bonds play a critical role in the global financial system and in everyday investment portfolios. At the heart of bond investing lies one powerful concept: bond yield.

Bond yield tells you how much return you can expect from a bond investment. It helps you compare different bonds, understand interest rate movements, and make informed investment decisions. Whether you are a beginner investor or someone trying to diversify beyond equities, understanding bond yield is essential.

In this guide, we break down bond yield in simple terms- what it means, how it works, why it matters, the different types of bond yields, and how to calculate them using easy examples.

What Is Bond Yield?

Bond yield is the return an investor earns from holding a bond. It is usually expressed as a percentage and reflects how much income you receive from a bond relative to its price.

In simple words, bond yield answers this question:

“How much am I earning on the money I invested in this bond?”

A bond pays interest, known as a coupon, at regular intervals. The yield tells you how valuable that interest is based on the price you paid for the bond and how long you hold it.

For example:

- If a bond pays ₹100 per year in interest

- And you bought it for ₹1,000

Your bond yield is 10%

However, bonds are traded in the market, and their prices change. This means the yield also changes, even if the interest payment stays the same.

Understanding Bonds: A Quick Refresher

Before diving deeper into bond yields, it helps to understand how bonds work.

A bond is essentially a loan. When you buy a bond:

- You lend money to a government, company, or institution

- In return, the issuer promises to pay you interest regularly

- At maturity, the issuer repays the original amount (called face value)

Bonds are popular because they:

- Provide predictable income

- Are generally less volatile than stocks

- Help balance risk in an investment portfolio

Because of these features, bonds are widely used by retirees, conservative investors, and institutions.

Why Bond Yield Matters

Bond yield is more than just a percentage, it is a powerful decision-making tool.

Here’s why bond yield is important:

1. Helps Compare Bonds

Two bonds may look similar but offer very different returns once you factor in price, maturity, and interest payments. Yield allows fair comparison.

2. Shows Real Return Potential

A bond with a lower interest rate might actually give you better returns if bought at a discount. Yield reveals the true earning power.

3. Indicates Risk Level

Higher yields often signal higher risk. Lower yields usually indicate safer investments, such as government bonds.

4. Reflects Market Conditions

Bond yields react to changes in interest rates, inflation, and economic outlook, making them a useful economic indicator.

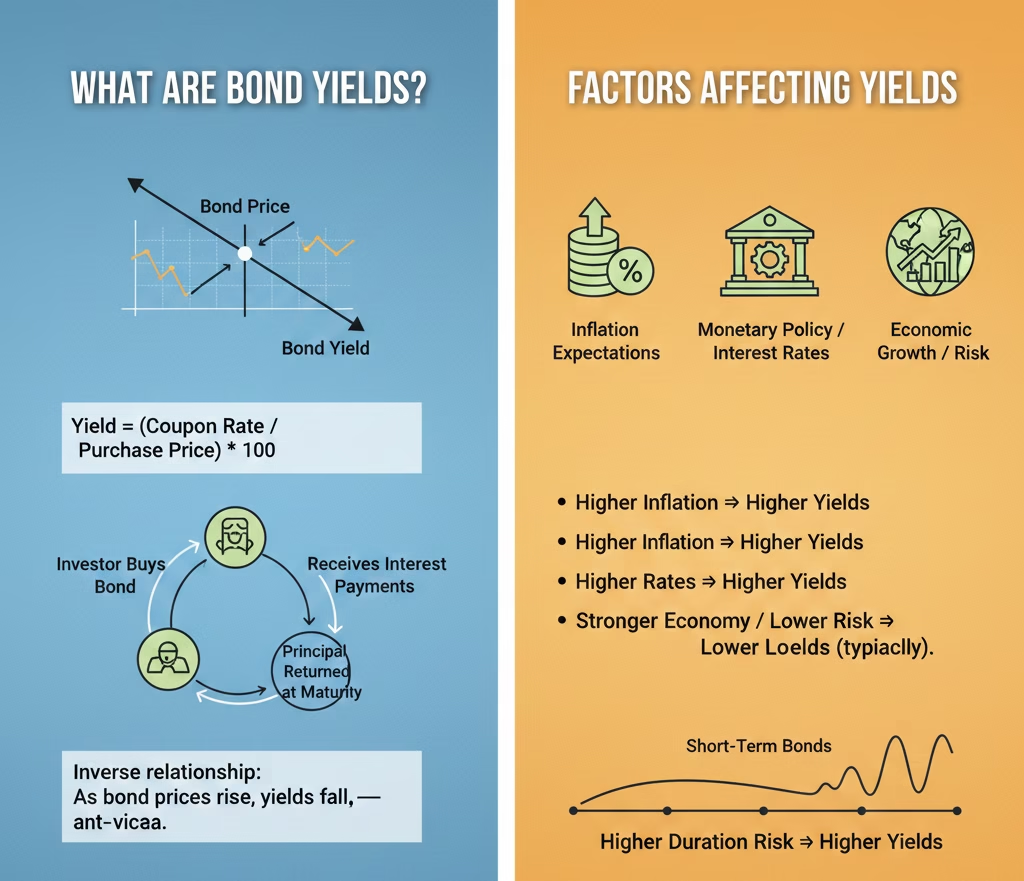

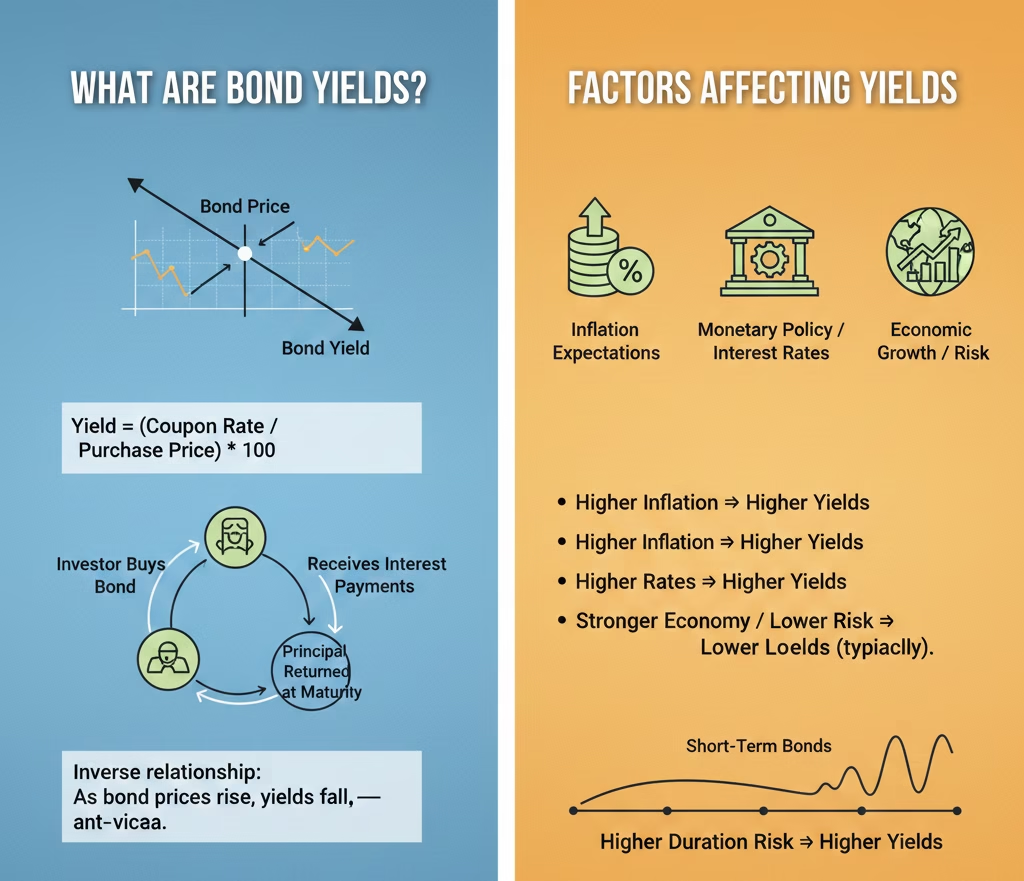

Key Factors That Influence Bond Yield

Bond yields don’t exist in isolation. Several factors influence how they move:

1. Interest Rates

When interest rates rise, newly issued bonds offer higher returns. Older bonds become less attractive, their prices fall, and yields rise.

When interest rates fall, existing bonds with higher interest become more valuable. Prices rise and yields fall.

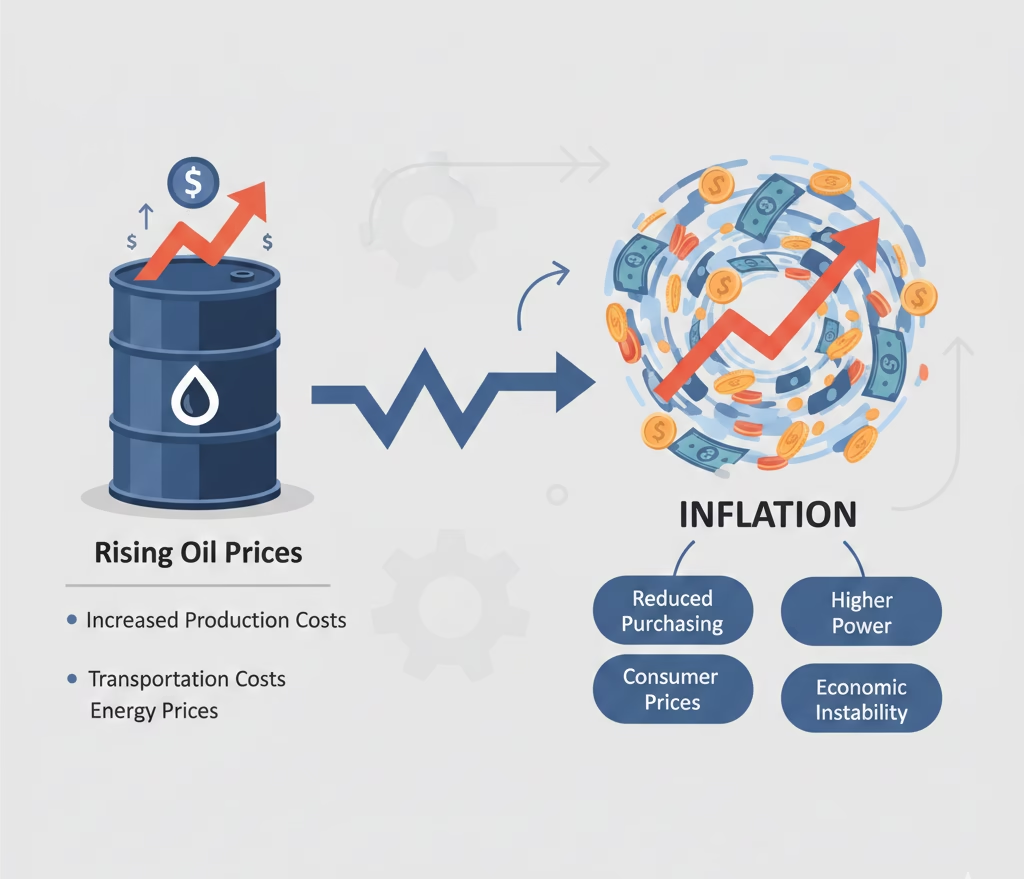

2. Inflation

Inflation reduces the purchasing power of money. When inflation rises, investors demand higher yields to compensate for this loss.

3. Credit Quality

Bonds issued by financially strong governments or companies usually offer lower yields. Riskier issuers must offer higher yields to attract investors.

4. Market Demand

If many investors rush to buy bonds (for safety), prices rise and yields fall. When demand drops, yields rise.

Bond Yield and Bond Price: The Inverse Relationship

One of the most important concepts in bond investing is this:

Bond prices and bond yields move in opposite directions.

How This Works:

- When bond prices go up → yields go down

- When bond prices go down → yields go up

Example:

Imagine a bond that pays ₹100 per year:

- If its price is ₹1,000 → yield is 10%

- If its price rises to ₹1,200 → yield drops to 8.3%

- If its price falls to ₹900 → yield rises to 11.1%

This inverse relationship is the backbone of bond market behavior.

Types of Bond Yield Explained

There isn’t just one type of bond yield. Different yield measures answer different investor questions. Let’s break them down clearly.

1. Coupon Yield (Nominal Yield)

Coupon yield is the simplest form of bond yield.

Formula:

CouponYield= (Annual Coupon Payment / Face Value) × 100

Example:

- Face value: ₹10,000

- Annual interest: ₹900

Coupon Yield = 9%

This yield never changes, even if the bond price changes in the market.

Limitation:

It does not reflect the price you actually paid for the bond.

2. Current Yield

Current yield improves on coupon yield by considering the bond’s market price.

Formula:

CurrentYield=(Annual Coupon Payment/CurrentMarket Price) ×100

Example:

- Annual interest: ₹900

- Market price: ₹9,800

Current Yield = 9.18%

If the price rises to ₹10,300:

- Current Yield = 8.74%

Current yield gives a realistic picture of returns for investors buying bonds from the secondary market.

3. Yield to Maturity (YTM)

Yield to maturity (YTM) is the most complete and widely used bond yield measure.

YTM tells you:

- Your annual return if you hold the bond until maturity

- Including interest payments and capital gain or loss

YTM considers:

- Coupon rate

- Market price

- Time remaining

- Face value

Why YTM Is Important

It converts all future payments into today’s value, giving a more accurate picture of returns.

Simplified YTM Formula:

YTM= [C + (FV − Price) / Years] ÷ [(FV + Price) /2]

YTM is best calculated using financial calculators or tools, but conceptually it answers:

“What will I earn per year if I hold this bond till the end?”

4. Yield to Call (YTC)

Some bonds can be repaid early by the issuer. These are called callable bonds.

Yield to Call (YTC) measures your return if the bond is called before maturity.

This is important because:

- Issuers usually call bonds when interest rates fall

- Investors may lose future interest payments

YTC helps investors prepare for early redemption scenarios.

5. Yield to Worst (YTW)

Yield to Worst is the lowest possible yield you might receive, assuming the worst-case scenario (call or maturity).

It is a conservative measure used by cautious investors.

6. Bond Equivalent Yield (BEY)

Many bonds pay interest twice a year.

Bond Equivalent Yield (BEY) converts semi-annual yield into an annual figure so it can be compared easily.

Example:

- Semi-annual yield: 5.98%

- BEY = 11.96%

7. Effective Annual Yield (EAY)

Effective Annual Yield (EAY) accounts for compounding.

Formula:

EAY= (1+ i/n)^n −1

Where:

- i = nominal rate

- n = number of payments per year

EAY is higher than BEY because it includes compounding effects.

8. Tax-Equivalent Yield

Some bonds offer tax-free interest.

Tax-equivalent yield helps compare tax-free bonds with taxable ones.

Example:

- Tax-free yield: 6%

- Tax bracket: 31.2%

Tax-Equivalent Yield = 8.72%

This makes tax-free bonds easier to evaluate.

Bond Yield Calculation Challenges

Real-world bond yield calculations are not always simple.

Common issues include:

- Partial years to maturity

- Accrued interest adjustments

- Clean price vs dirty price

- Varying payment schedules

Professional platforms usually quote bonds using clean prices, excluding accrued interest.

How Rising Bond Yields Affect Investors

Rising yields often worry investors, but context matters.

Short-Term Impact:

- Bond prices fall

- Existing bond values decline

Long-Term Benefit:

- Higher reinvestment rates

- Better future income

While rising yields may hurt short-term bond prices, they often improve long-term returns for patient investors.

How to Evaluate Bond Yield Before Investing

Before investing in a bond, consider the following:

- Compare YTM across similar bonds

- Check credit ratings

- Understand call features

- Consider tax impact

- Match yield with your risk tolerance

Bond yield should align with your financial goals, not just offer the highest return.

Conclusion: Why Bond Yield Knowledge Matters

Bond yield is the foundation of smart bond investing. It goes beyond interest rates and reveals the true return potential of a bond. From coupon yield to yield to maturity, each measure offers a unique perspective.

Understanding bond yield helps you:

- Compare bonds confidently

- Manage risk better

- Respond wisely to interest rate changes

In a world of shifting markets and economic uncertainty, bond yield brings clarity and confidence to fixed-income investing.

Other topics you might be interested in:

What Is the Federal Reserve? Meaning, Role and Why It Matters

Economic Data Explained: How Macro Numbers Shape Financial Markets

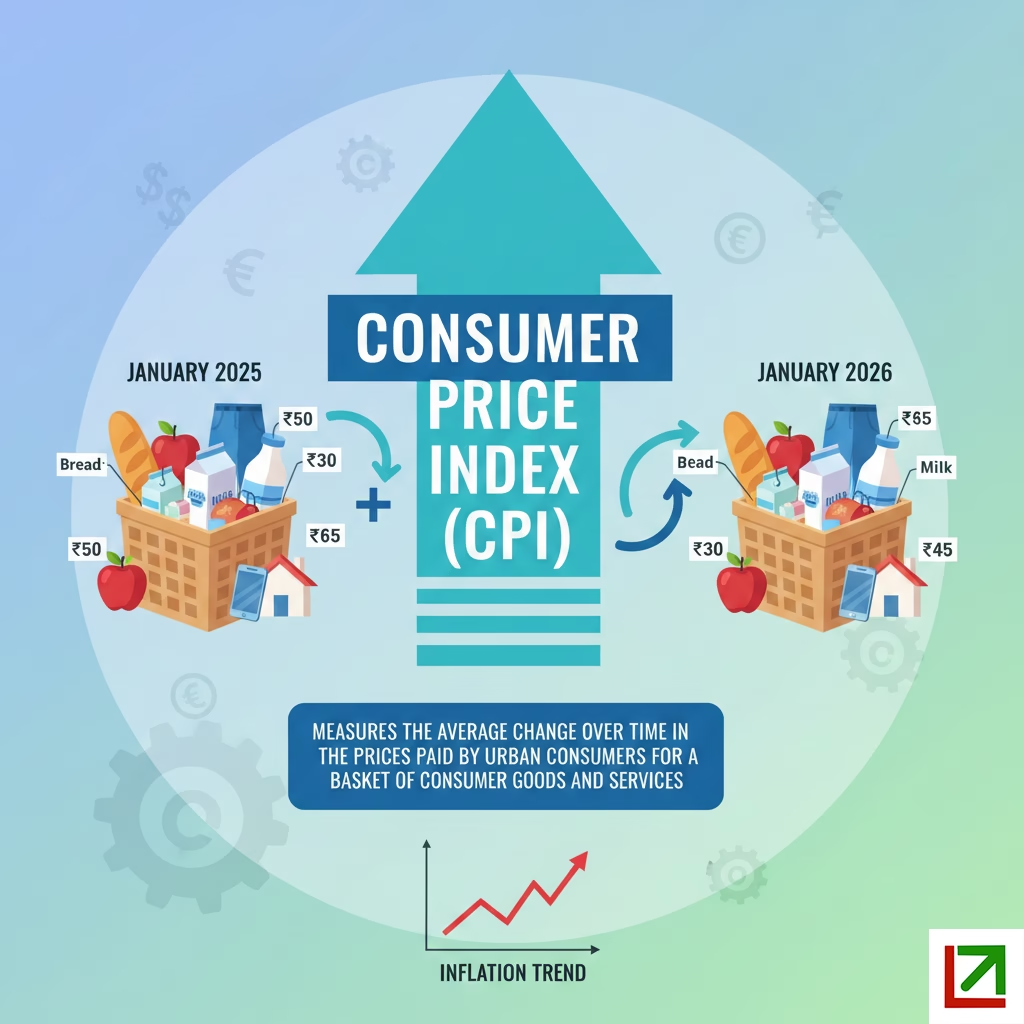

What Is Consumer Price Index (CPI)? Meaning, Calculation, and Why It Matters

Gross Domestic Product (GDP): Meaning, Formula, Types & Importance

Recession: Definition, Causes, Examples, and How It Affects You