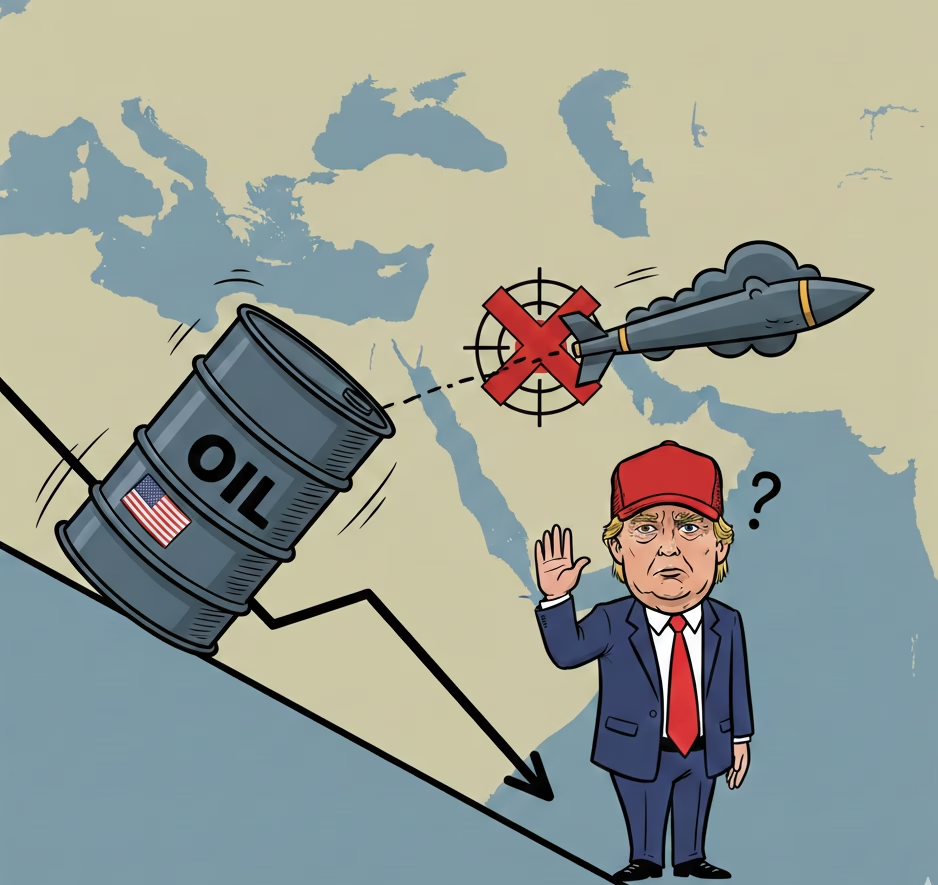

Oil prices declined for the first time in nearly a week after US President Donald Trump signaled that the United States may pause any immediate military action against Iran. The move reduced fears of a sudden supply disruption from one of the world’s key oil-producing regions, easing pressure on global energy markets.

Brent crude, the global oil benchmark, fell as much as 2.9% to trade below $65 per barrel after climbing roughly 11% over the past week. US oil prices, measured by West Texas Intermediate (WTI), also slipped and hovered near $60 per barrel. The drop came after a strong rally driven by rising geopolitical tensions in the Middle East.

President Trump told reporters that he had been informed that Iranian authorities were slowing or stopping the killing of protesters, lowering the likelihood of an immediate US military response. Markets interpreted these comments as a sign that tensions may not escalate further in the near term.

Tensions Remain, but Immediate Fears Ease

While oil prices pulled back, the situation in Iran remains unstable. Iranian authorities temporarily closed airspace around Tehran, signaling ongoing security concerns. At the same time, the US moved some nonessential personnel away from military bases in the region, including the Al Udeid Air Base in Qatar, as a precaution against possible retaliation if conflict were to break out.

Earlier this month, protests erupted across Iran following a harsh government crackdown. President Trump had warned that the US would respond if Iranian authorities harmed protesters. Just days earlier, he suggested military action was possible, fueling sharp gains in oil prices as traders worried about supply disruptions.

However, Trump’s more cautious tone this week cooled those fears. He said he had received information from what he described as “important sources” indicating that violence against protesters was subsiding and that large-scale executions were not planned. While he acknowledged the information could later prove inaccurate, the comments were enough to calm markets.

Why Iran Matters to Oil Markets

Iran is one of the world’s major oil producers and a key member of OPEC. Any disruption to its oil output or exports can quickly affect global supply. More importantly, Iran sits near the Strait of Hormuz, a narrow shipping route through which a significant share of the world’s oil passes every day. Even the threat of conflict in this area can push oil prices higher.

Oil prices had already been rising at the start of the year due to political instability in Iran and ongoing turmoil in Venezuela. These issues restored a “risk premium” to oil prices after several months of losses driven by concerns that global supply would exceed demand.

Trump also revealed that he held a phone call with Venezuela’s acting president, Delcy Rodriguez, during which oil was discussed. Venezuela’s oil industry has been severely disrupted by political and economic chaos, adding another layer of uncertainty to global energy supply.

Inventory Data Adds Pressure

Beyond geopolitics, fresh data from the US government also weighed on oil prices. Nationwide crude oil stockpiles rose by 3.4 million barrels last week, marking the largest increase since early November. Rising inventories suggest that supply is currently outpacing demand, which can put downward pressure on prices.

At the same time, more Venezuelan oil is reportedly heading to the US, easing some supply concerns. A disruption at a key Black Sea oil terminal has also affected regional flows, contributing to unusual pricing differences between Brent and WTI. US oil is now trading at one of its deepest discounts to Brent in more than a year.

Market Outlook: Rally or Reversal?

Some analysts believe oil prices could still climb if tensions flare again. According to Robert Rennie, head of commodity research at Westpac Banking Corp., Brent crude could test levels as high as $75 per barrel if geopolitical risks return to the forefront.

However, he also warned that oil prices could fall sharply once the situation stabilizes. Similar patterns were seen during the Iran-Israel conflict last June, when prices surged during the crisis but dropped quickly once fears eased.

In short, oil markets remain highly sensitive to political headlines, with prices moving rapidly on signs of escalation or restraint.

Analysis: What This Means for Oil Prices and the Economy

Short-Term Impact on Oil Prices

In the near term, oil prices are likely to remain volatile. As long as the situation in Iran remains unresolved, markets will react to every new development. A pause in US military action removes some immediate risk, which explains the recent pullback in prices.

However, volatility will persist because the underlying issues have not disappeared. Protests in Iran, US troop movements, and warnings of retaliation all suggest that the situation could worsen quickly. Any sign of renewed violence or military action would likely push oil prices higher again.

Medium-Term Oil Price Outlook

Over the next few months, oil prices will depend on two main factors: geopolitics and supply-demand balance. If tensions in Iran and Venezuela ease, and if global oil production continues to rise, prices could drift lower.

On the other hand, if conflicts disrupt oil production or shipping routes, prices could spike sharply. Even without actual supply losses, fear alone can drive prices higher, as traders price in worst-case scenarios.

Impact on Inflation

Oil prices play a major role in inflation. Higher oil prices raise fuel costs, transportation expenses, and production costs for businesses. If oil prices climb again, consumers could face higher prices at the pump and increased costs for goods and services.

A sustained rise in oil prices would make it harder for central banks to control inflation, especially in countries that rely heavily on imported energy.

Impact on Economic Growth

For oil-importing countries, higher oil prices act like a tax on the economy. Consumers spend more on energy and less on other goods, slowing overall economic activity. Businesses face higher operating costs, which can reduce profits and investment.

On the other hand, oil-exporting countries benefit from higher prices through increased government revenue and stronger trade balances. This uneven impact means global growth could become more fragmented.

Impact on Financial Markets

Energy stocks often rise when oil prices increase, while transportation, airline, and manufacturing stocks may suffer. Continued volatility in oil markets could lead to sharper swings in stock markets, especially in sectors sensitive to fuel costs.

Bond markets may also react if higher oil prices feed into inflation expectations, potentially pushing interest rates higher.

Bottom Line

Oil prices fell because fears of an immediate US military strike on Iran eased, not because risks disappeared. The situation remains fragile, and markets are likely to stay on edge. For the global economy, the key risk is renewed instability that pushes oil prices higher for longer, adding pressure to inflation and slowing growth.

For now, oil markets are caught between calming political signals and ongoing uncertainty, a balance that could shift quickly with the next headline.

Read also:

Wells Fargo Q4 2025 Earnings: Profit Miss, Interest Income Falls Short, Shares Slide

Bank of America (BAC) Beats Q4 Earnings Estimates as Interest Income and Trading Revenue Rise

XRP Price Rises as Ripple Secures Key Luxembourg EMI License