Avoid Insurance Frauds: Common Scams and How to Stay Safe

Insurance is meant to protect us during difficult moments- accidents, illness, property damage, or the loss of a loved one. Unfortunately, insurance fraud has become one of the most common and costly financial crimes worldwide. While most people are honest and hardworking, scammers continue to exploit trust, urgency, and lack of awareness.

Insurance fraud is often misunderstood as a harmless or victimless crime. In reality, its cost is passed on to everyone through higher premiums, delayed claims, emotional distress, and financial losses. From fake insurance agents and staged car accidents to phishing emails and phony life insurance policies, fraudsters are constantly finding new ways to deceive people.

This guide explains how to avoid insurance frauds, the most common scams to watch out for, and practical steps you can take to protect yourself, your family, and your business.

What Is Insurance Fraud?

Insurance fraud is any dishonest act committed to obtain money, benefits, or services from an insurance company through false information, deception, or misrepresentation.

Fraud can be committed by:

- Scammers pretending to be insurers or brokers

- Policyholders making false claims

- Contractors or repair shops inflating damage

- Organized groups staging accidents

Insurance fraud affects auto, home, health, travel, business, and life insurance policies alike.

Why Insurance Fraud Is a Serious Problem

Many people assume insurance fraud only affects large corporations. That assumption is wrong.

Financial Impact

Insurance fraud costs billions every year. These losses eventually show up as:

- Higher insurance premiums

- Stricter claim investigations

- Slower payouts for genuine claims

Emotional and Psychological Impact

Victims of fraud often experience:

- Stress and anxiety

- Feelings of shame or embarrassment

- Loss of trust in financial institutions

- Fear of future scams

Fraud doesn’t just drain bank accounts, it damages confidence and peace of mind.

Common Types of Insurance Frauds and Scams

Understanding common scams is the first and most important step in avoiding them.

Auto Insurance Scams to Watch Out For

Forced Rear-End Accidents

In this scam, a driver intentionally causes you to hit their car by stopping suddenly, cutting in front of you, or disconnecting brake lights. The scammer then claims serious injuries and expensive property damage.

How to protect yourself:

- Maintain safe following distances

- Install a dash camera

- Call the police after any accident, even minor ones

- Take photos of vehicles, passengers, and surroundings

Staged Accidents

Two or more drivers deliberately cause an accident to file fake claims. Innocent drivers and pedestrians may get injured when these scams go wrong.

Tip: Always document the accident scene and avoid admitting fault.

Phantom Passengers

After an accident, scammers may claim there was another passenger who was injured, even if no such person existed.

Protection steps:

- Count the number of people in the other vehicle

- Take clear photos of passengers and vehicles

- Collect witness information

Fake Hit-and-Run Reports

Some drivers damage their own cars and then report a fake hit-and-run accident.

Advice: If you’re involved in an accident, insist on a police report.

Repair Shop and Injury Fraud

Scammers may push you to a specific repair shop or chiropractor who inflates repair costs or invents injuries.

Tip: Choose your own trusted repair shop and medical provider.

Home Insurance Scams You Should Know

Fake Contractors and Door-to-Door Scams

A contractor knocks on your door claiming to have leftover materials from a nearby job. They may demand full payment upfront or accept only cash.

Red flags:

- Pressure to act immediately

- Requests for full payment in advance

- No written contract or license

Operation “Leaky Pipes”

In this scheme, contractors and public adjusters encourage homeowners to file false claims for water damage that never occurred.

Warning: Filing false claims can lead to policy cancellation, legal trouble, and long-term financial damage.

Auto Repair and Parts Scams

Counterfeit Airbags

After accidents, counterfeit airbags may be installed instead of factory-approved ones. These fake airbags may not deploy properly and can be deadly.

Safety tip: Always use reputable repair shops and ask for genuine parts documentation.

Windshield Replacement Rip-Offs

A stranger offers to replace your windshield cheaply and asks for your insurance details. They then file a fake claim.

Advice: Only use well-known and insured repair shops.

Life Insurance Scams to Avoid

Life insurance scams often target older adults, but anyone can fall victim.

Requests for Personal Information or Urgent Payments

Scammers pretend to work for your insurance company and claim there’s an issue with your policy or payment.

What to do:

- Never share personal or payment details

- Contact your insurer directly using official contact information

Fake Beneficiary Scams

You may be told you’re entitled to insurance money from a deceased relative, but must pay a “fee” first.

Rule to remember: Legitimate insurers never ask beneficiaries to pay fees upfront.

Phony Life Insurance Policies

Fake documents and websites make non-existent policies look real.

How to verify:

- Check the insurer with your state or provincial regulator

- Confirm the agent’s license

Pressure to Switch or Upgrade Policies

Dishonest agents may push you to switch policies frequently or borrow from your existing policy for unnecessary upgrades.

Smart move: Ask for written explanations and take time to review changes.

Misleading Advertised Rates

Extremely low advertised rates may only apply to a small group of people. Others are offered much higher premiums after applying.

Tip: Compare multiple insurers before committing.

Business Insurance Scams

Business owners are frequent targets of insurance fraud.

Fake Brokers and Policies

Scammers sell fake business insurance that provides no coverage at all.

Warning signs:

- Unlicensed agents

- Requests for unusual payment methods

- Lack of official documentation

Phishing Attacks

Fraudsters send emails or texts that look like they’re from legitimate insurers, urging immediate action.

Protection tip: Never click on links in unsolicited messages. Contact your insurer directly instead.

How to Identify an Insurance Scam

Here are common warning signs across all types of insurance fraud:

- Unsolicited calls, emails, or messages

- Pressure to act quickly

- Requests for payment via gift cards or wire transfers

- Offers that seem too good to be true

- Lack of verifiable licensing

If something feels wrong, trust your instincts.

How to Verify an Insurance Company or Broker

Before buying any policy:

- Check with your state or provincial insurance regulator

- Confirm licenses and registrations

- Contact the insurer directly using official contact details

- Avoid relying on social media ads alone

Verification takes time, but it’s worth it.

What to Do If You Suspect Insurance Fraud

If you believe you’ve encountered a scam:

- Stop communicating with the suspected scammer

- Do not send money or information

- Contact your insurer or regulator

- Report the incident to fraud authorities

- Secure your bank and online accounts

- Inform family and friends

Reporting fraud helps protect others in your community.

How to Protect Yourself From Insurance Frauds

You can reduce your risk by following these simple practices:

- Buy insurance only from verified providers

- Never share sensitive information unless necessary

- Be cautious with unsolicited offers

- Keep records of policies and communications

- Use fraud alerts on bank accounts

- Stay informed about common scams

Knowledge is your strongest defense.

Final Thoughts: Stay Alert, Stay Protected

Insurance fraud is a growing problem, but falling victim to it is not inevitable. Scammers rely on confusion, urgency, and lack of awareness. By understanding how insurance scams work and taking time to verify offers, you can protect your finances, your reputation, and your peace of mind.

Staying cautious doesn’t mean being fearful, it means being informed.

Disclaimer

This article is for informational and educational purposes only and does not constitute legal, financial, or insurance advice. Insurance rules, regulations, and fraud reporting procedures vary by country, state, and insurer. Always consult licensed insurance professionals, legal advisors, or official regulatory authorities for advice specific to your situation.

People frequently ask:

What is insurance fraud?

Insurance fraud is when someone lies or uses false information to get money or benefits from an insurance policy.

How can I avoid insurance scams?

Verify the insurer, avoid urgent offers, never share personal details, and report suspicious activity.

What are common signs of insurance fraud?

Unsolicited calls, pressure to act fast, extremely low prices, and unusual payment requests.

Who should I report insurance fraud to?

You can report it to insurance regulators, anti-fraud agencies, and local law enforcement.

Can insurance fraud affect my premiums?

Yes. Fraud increases costs for insurers, which often leads to higher premiums for everyone.

Other topics you might be interested in:

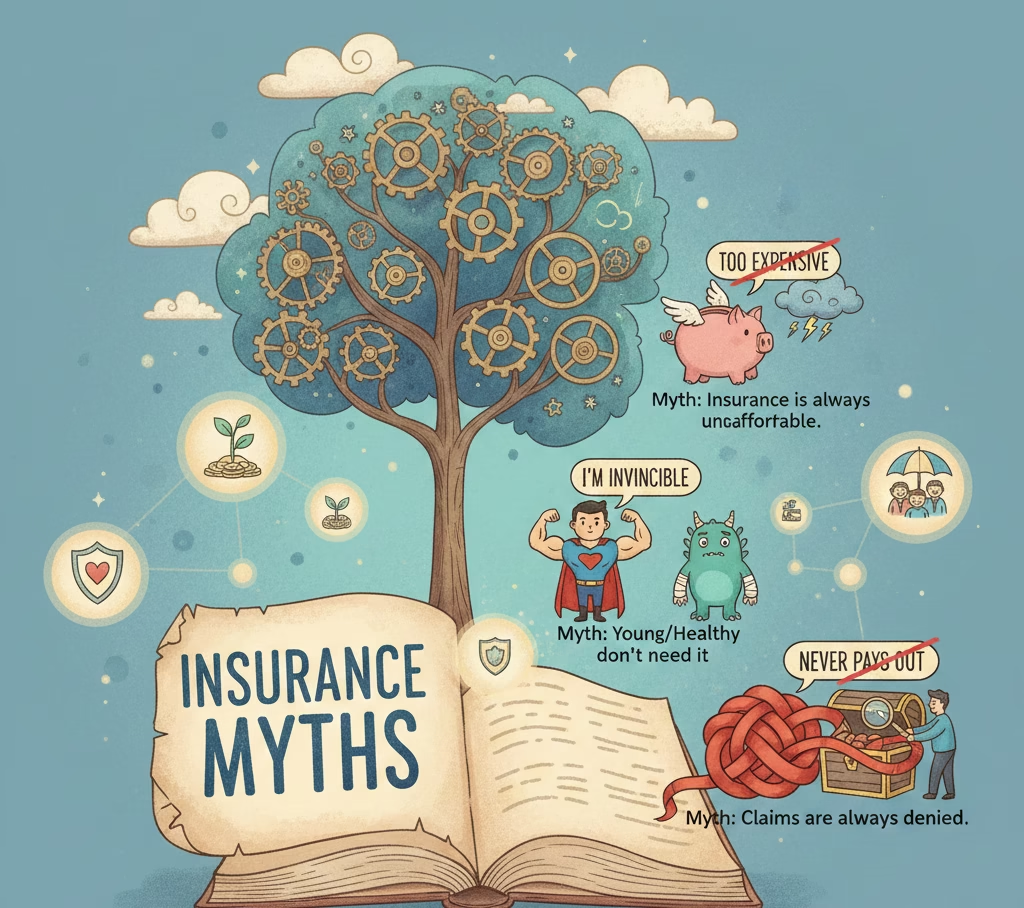

10 Insurance Myths That Are Costing You More Money Than You Think

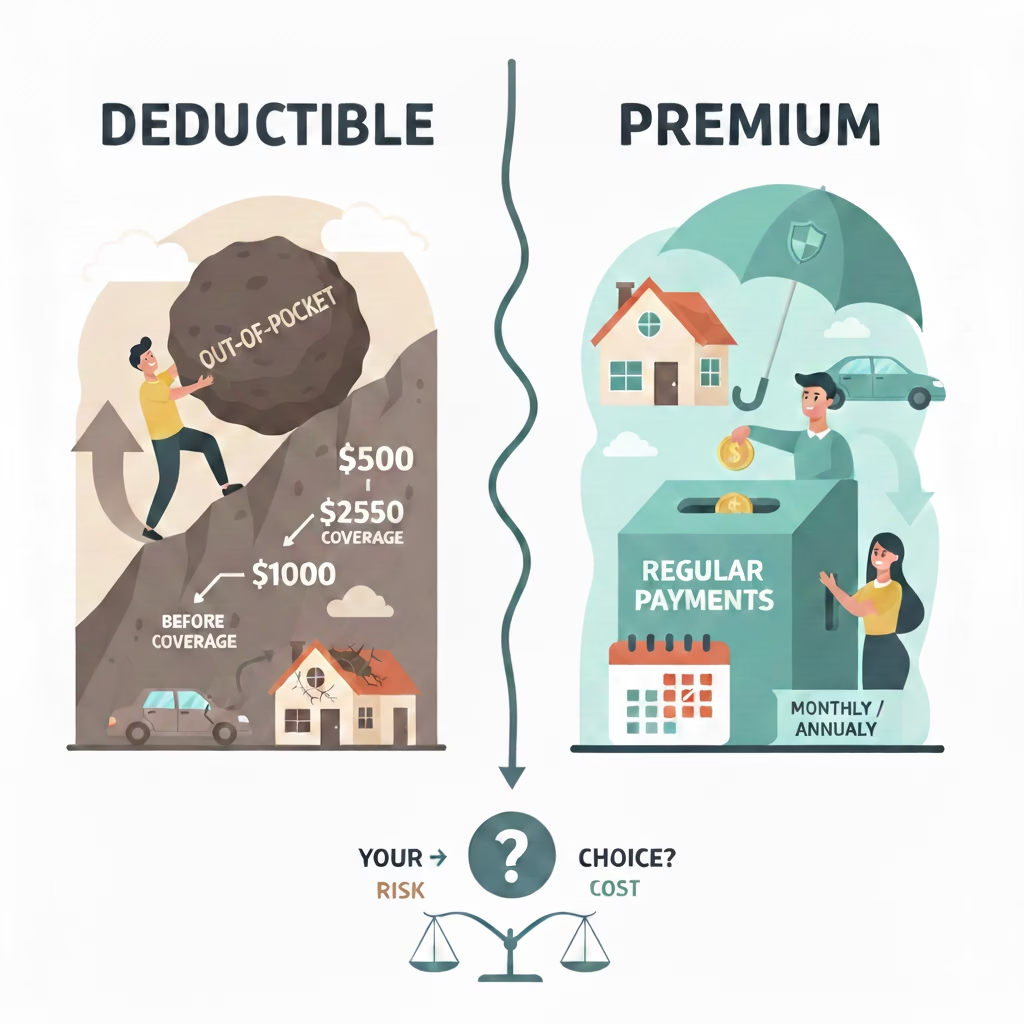

Insurance Deductible vs Premium: What’s the Difference and Which One Costs You More?

Health Insurance Explained: What It Is, How It Works, and Why You Need It

Pet Insurance Explained: Cost, Coverage, and Whether It’s Worth It